We believe that emerging and frontier markets offer attractive investment opportunities, thanks to long-term trends in demographics, deregulation, offshore outsourcing and improving corporate governance.

Why Emerging Markets and Frontier Markets Now?

- Emerging and frontier markets are uniquely poised to benefit from technological and demographic trends:

- The majority of the world’s millennials live in EM; the millennial population in China alone is greater than the entire population of the U.S.

- 9 out of 10 new online users will come from EM over the next decade.

- The convergence of a young population with increased access to mobile services will support above-average growth rates in

e-commerce and consumption.

- Valuations are favorable relative to developed equity markets and its own history. Many EM companies have recently met or beat expectations in earnings results, but most investors are still underweight the asset class.

- Given recent passive flows and index dislocations, there is a great opportunity for active management. For example, Argentina joined MSCI EM in June 2019, right before a significant currency devaluation and stock market drop in August 2019. An index mandate would have unwittingly walked into this crisis.

- Frontier markets have even lower correlations to developed markets and may be fairly insulated from global trade war-related volatility.

Higher Gross Domestic Product growth rates may help drive profits and returns.

Demographic dividends can drive regional and domestic growth.

Emerging markets offer compelling diversification benefits for long-term investors.

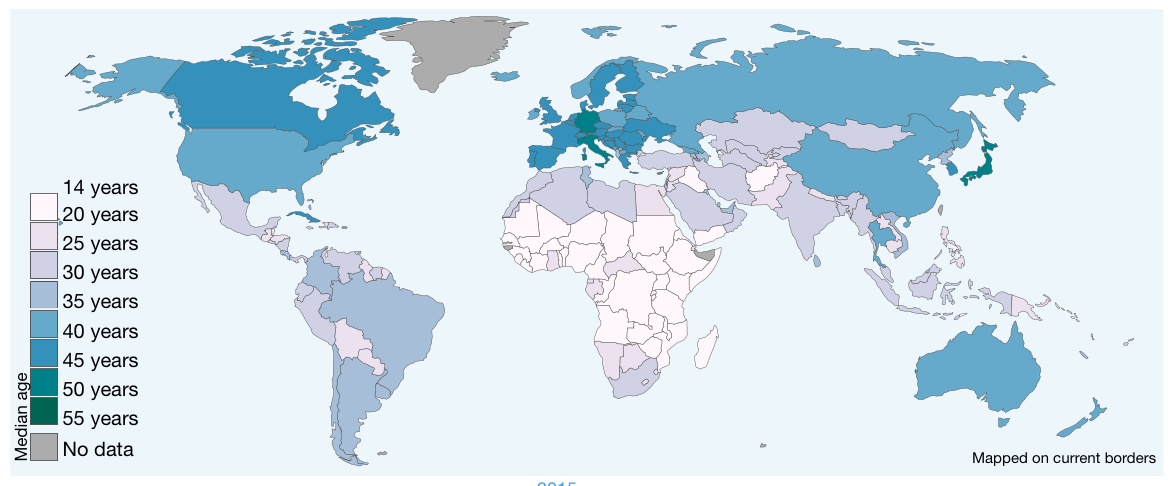

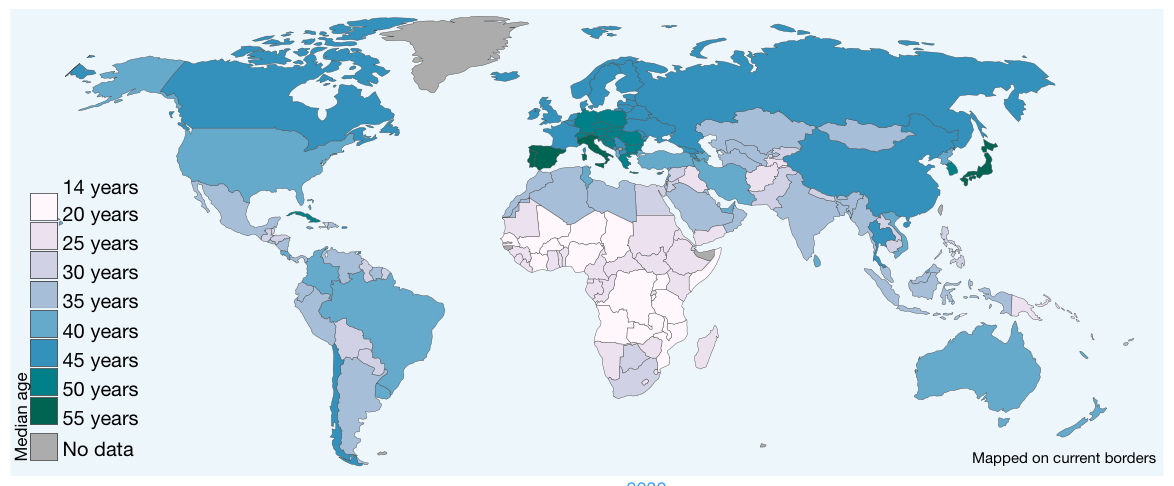

Demographic Dividends May Drive Regional and Domestic Growth.

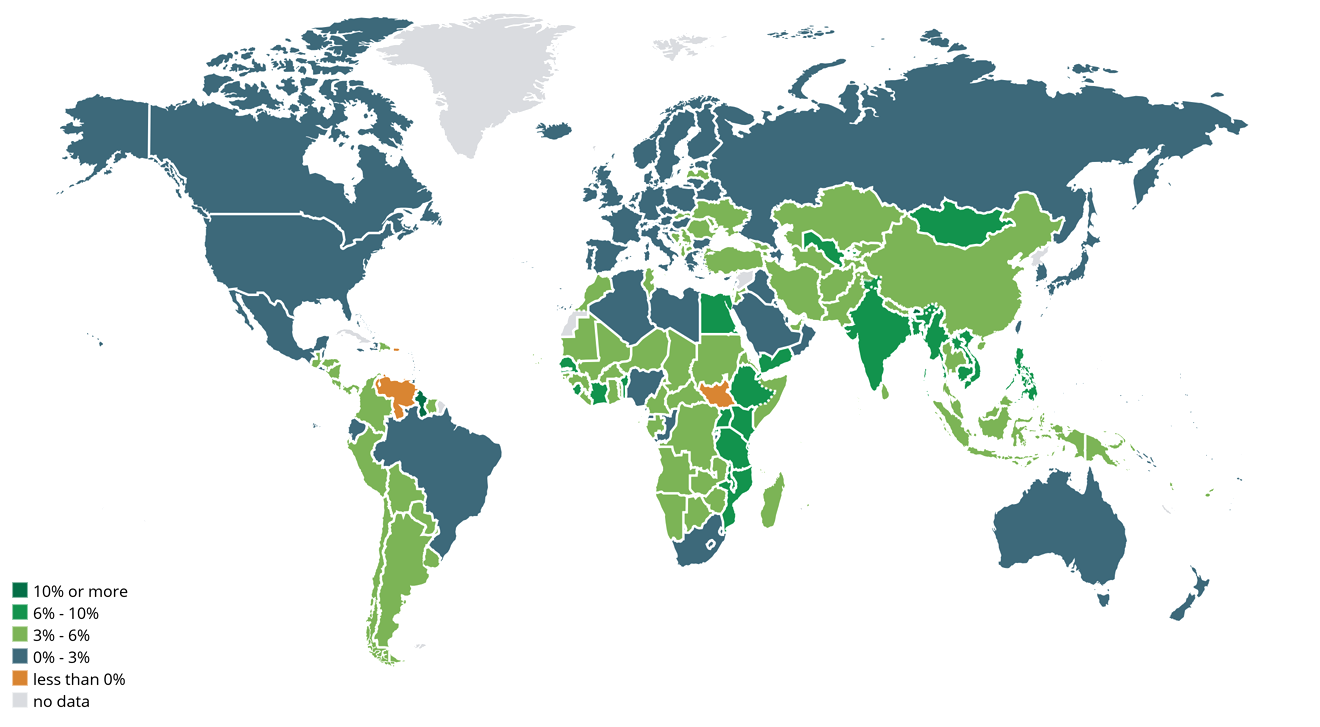

Median Age, 2015

Much of Africa, Asia, and Latin America have young and growing population.

Median Age, 2030

Larger labor forces as a % of a country’s population can mean greater economic activity, consumption and GDP growth.

*Source UN Population Division (Median Age) 2015 Revision.

Note: 1950 to 2015 show historical estimates. From 2020 the UN projections (medium variant) are shown.

For Illustrative Purposes Only.

Higher Growth Rates May Help Drive Profits and Returns.

| REAL GDP GROWTH (Annual % Change)* |

2023 (Projected) |

|---|---|

| China | 5.5 |

| Vietnam | 6.5 |

| India | 8.2 |

| Indonesia | 5.6 |

| Pakistan | 5.0 |

| United States | 1.4 |

| Euro Area | 1.4 |

| Japan | 0.5 |

*Source ©IMF, 2018, World Economic Outlook (April 2018)

For Illustrative Purposes Only.